Healthier

Together.

Retirement and health plan benefits for employees and pastors of Alliance churches, International Workers, the National Office, and affiliated support organizations.

THE FUTURE OF HEALTHCARE

Our Passion is to Serve the Christian & Missionary Alliance

At Alliance Benefits, our vision for the future of healthcare is deeply intertwined with our unwavering commitment to serve The Christian and Missionary Alliance community. We are dedicated to transforming the landscape of health benefits through innovative solutions that not only meet the evolving needs of our members but also uphold the values of compassion, respect, and integrity. By focusing on cost-effective, competitive insurance and retirement programs, we aim to ensure that the health and well-being of pastors, employees, International Workers, and retirees of Alliance churches and affiliated organizations are secured. Join us as we pave the way towards a healthier future, guided by our passion to serve and honor God in all that we do.

Compassion

Driven by a deep sense of compassion, Alliance Benefits prioritizes the well-being of The Christian and Missionary Alliance community, ensuring every member receives personalized, attentive care in their health and retirement planning.

Respect

Alliance Benefits embodies respect in all interactions, recognizing and valuing the unique contributions and needs of each member within The Christian and Missionary Alliance community.

Integrity

Alliance Benefits steadfastly upholds integrity in every aspect of their service, ensuring transparent, ethical practices are the foundation of their mission to support The Christian and Missionary Alliance community.

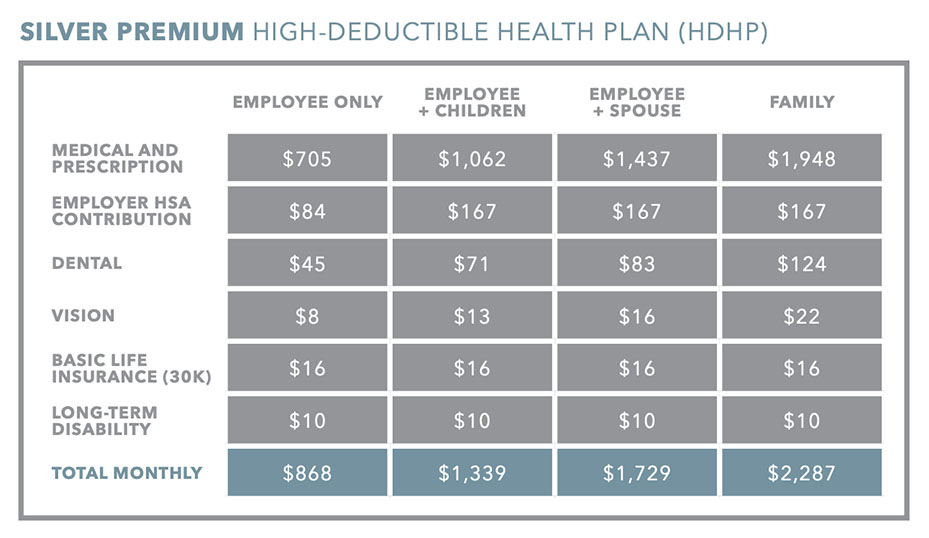

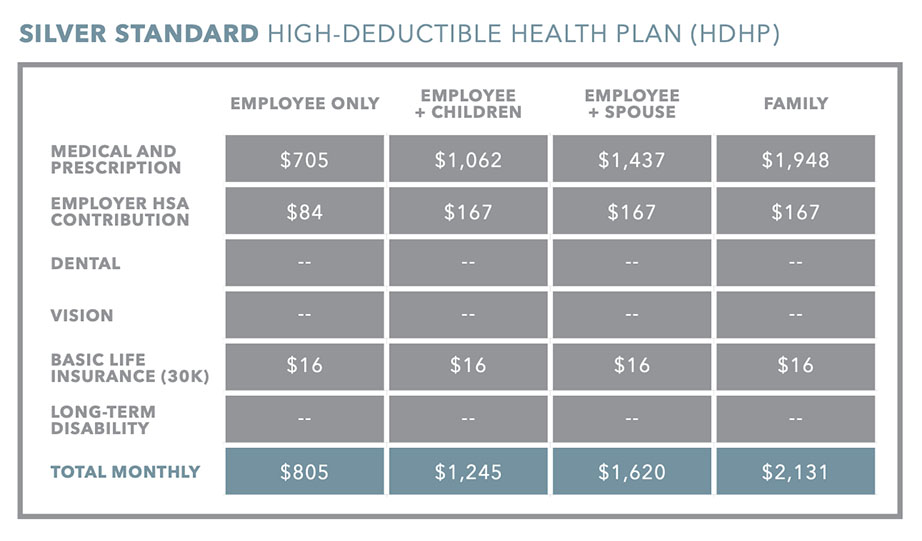

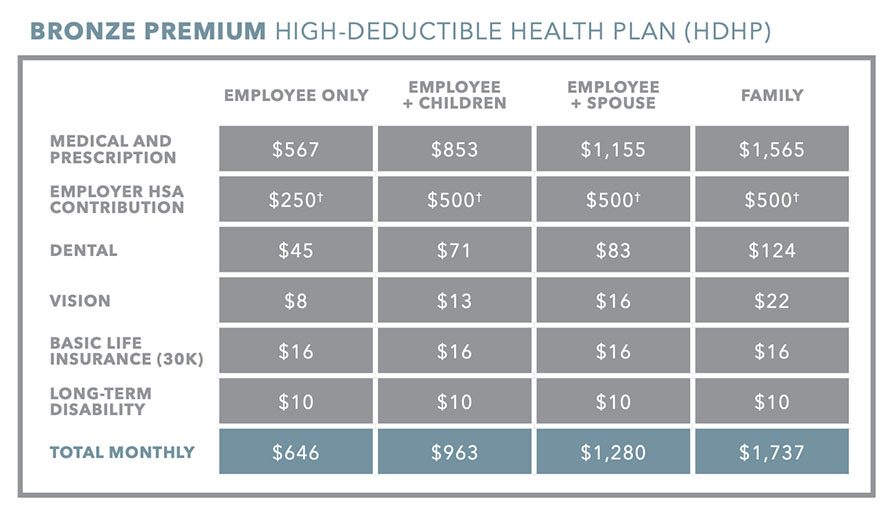

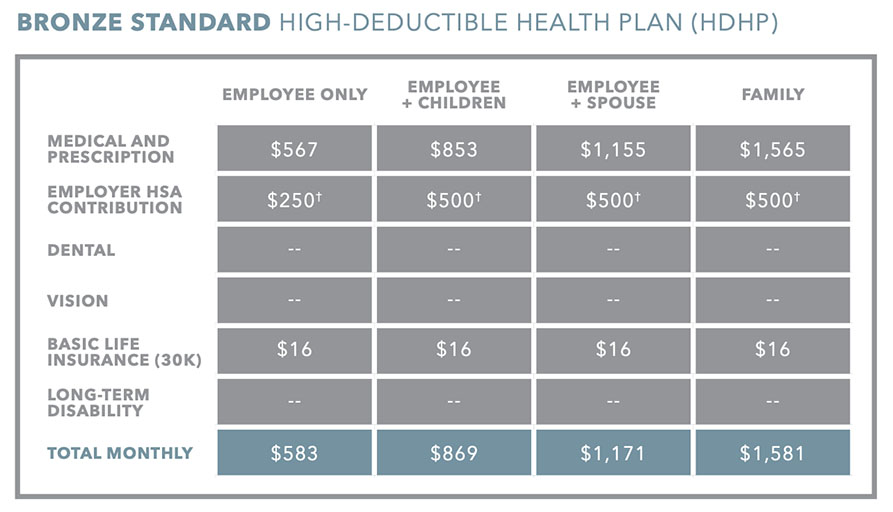

Health Plan Rates

Alliance Benefits offers competitive health plan rates, designed to provide exceptional value and comprehensive coverage to The Christian and Missionary Alliance community, ensuring financial peace of mind and well-being.

GET STARTED WITH ALLIANCE BENEFITS

Resources to Guide You Through Our Benefits

Financial

Resources

Health Plan

Resources

403B Plan

Resources

Medicare

Resources

What People are Saying

I can honestly say that if it were not for the quality and coverage of the Alliance Health Plan, my wife would not be alive today. From the countless hours of rehab and prosthetics to the emergency services she needed due to her diabetes, we never had to worry about having limited options or being rejected by the plan. The Alliance Health Plan protected us from worry and was easy to navigate through the mountain of doctors and hospital bills. We are forever grateful for the peace of mind and care the Alliance Health Plan provided us during the most difficult times.

I appreciate all that Alliance Benefits is doing to promote preventative care and healthy lifestyle choices. Too often, we find ourselves undergoing surgery and taking numerous medications to treat health issues that could have been prevented. Your efforts towards promoting healthy living

are commendable. Keep up the great work!

OUR BLOG

Helpful Insights To Help You Better Understand Your Benefits

Your microbiome is as unique as you. From birth, you have a collection of microorganisms, a microbiome, that will grow…

Alliance Family, I hope this message finds each of you well. Today, I am reaching out to share an important…

In today’s fast-paced and often stressful world, it’s important to prioritize mental health. Recognizing this need, the Alliance Health Plan…